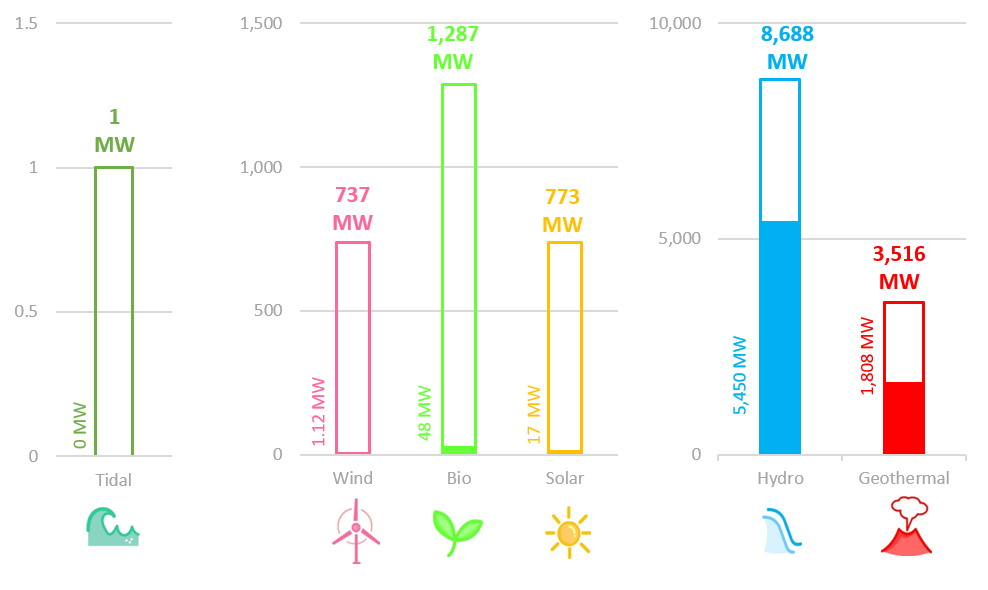

The Governmental Regulation (PP No. 79/2014) on National Energy Policy defines targets for RE of 23% share in total energy supply by 2025 and 31% by 2050. ESDM still have to define a detailed plan in term of installed capacity for RE power plant. However, the existing plan for 2025 is shown in Figure 4.

RE Targets by 2025 in MW, compared to existing installed capacity in 2017

Source: ESDM (for 2025 target) and Handbook of energy & economic statistics of Indonesia 2018

Source: ESDM (for 2025 target) and Handbook of energy & economic statistics of Indonesia 2018

The total installed capacity of RE in Indonesia is around 7.3 GW in 2017. It consists of two main RE sources hydro and geothermal as shown in Figure 5. Hydropower has the highest share (74%). Nevertheless, although Indonesia has abundant hydro resources, most of them are in remote areas, far away from the major energy demand. Around 94% of hydropower installed capacity comes from large hydropower. Mini and micro hydropower that are important means for rural electrification plays only minor role. The second largest share in installed capacity of RE is geothermal (24.7%). Considering the fact that Indonesia is the country with the largest geothermal potential in the world, yet Indonesia is still behind United States and Philippines in term of geothermal power generation. There are still significant untapped opportunities available for future geothermal exploitation.

Indonesia's RE Installed Capacity in 2017 (%)

Source: Handbook of energy & economic statistics of Indonesia (2018)

Note: The diagram only considers the PLN’s power plants.

Figure 6 illustrates the energy generation from RE in Indonesia. Around 32 TWh of electricity comes from RE sources. Hydropower and geothermal energy account for 98% of this amount. New RE i.e. solar and wind power still plays a very small role in Indonesia.

Indonesia's Renewable Energy Electricity Generation in 2017 (%)

Source: Handbook of energy & economic statistics of Indonesia (2018)

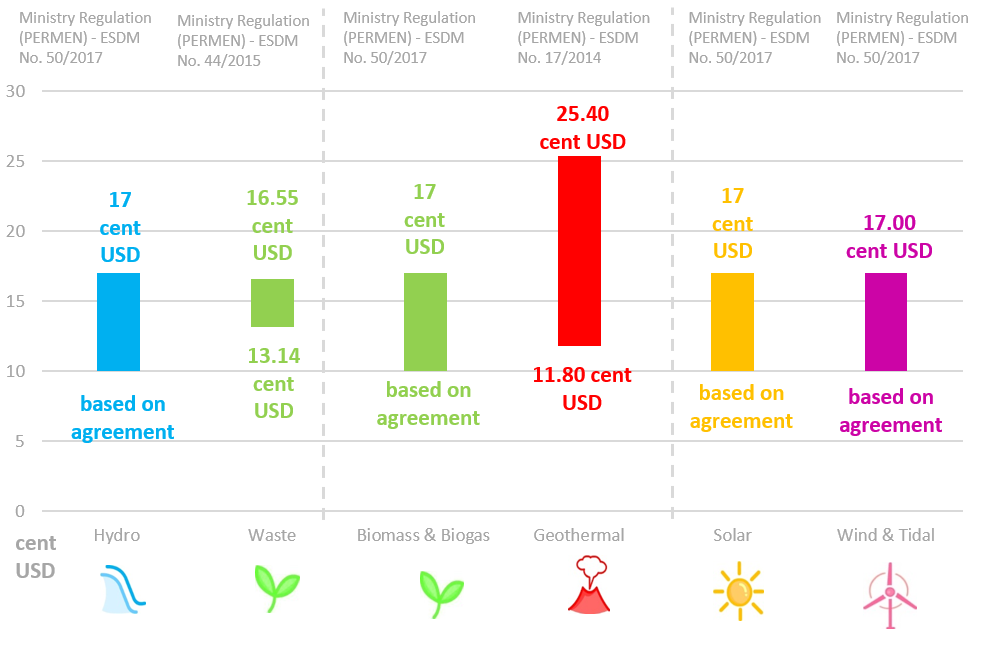

Selling Tariffs of Electricity

In August 2017, the Indonesia Ministry of ESDM introduced new electricity purchase price and procurement schemes replacing Feed-in Tariff (FiT) as shown in Figure 7 for a range of renewable energy sources. The Minister issued a new renewable energy regulation, Regulation 50/2017 on the Use of Renewable Energy for the Provision of Electricity. Regulation 50/2017 revises the previous regulation number 12/2017. According to the current regulation, the power purchase is executed through direct selection and auction with quota, as the previous regulation enabled power purchasing through auction and direct award.

Indonesia’s Feed in Tariff System for RE

Source: Ministry Regulation (ESDM) No. 9/2018, No. 17/2014, No. 19/2 016, No. 44/2015

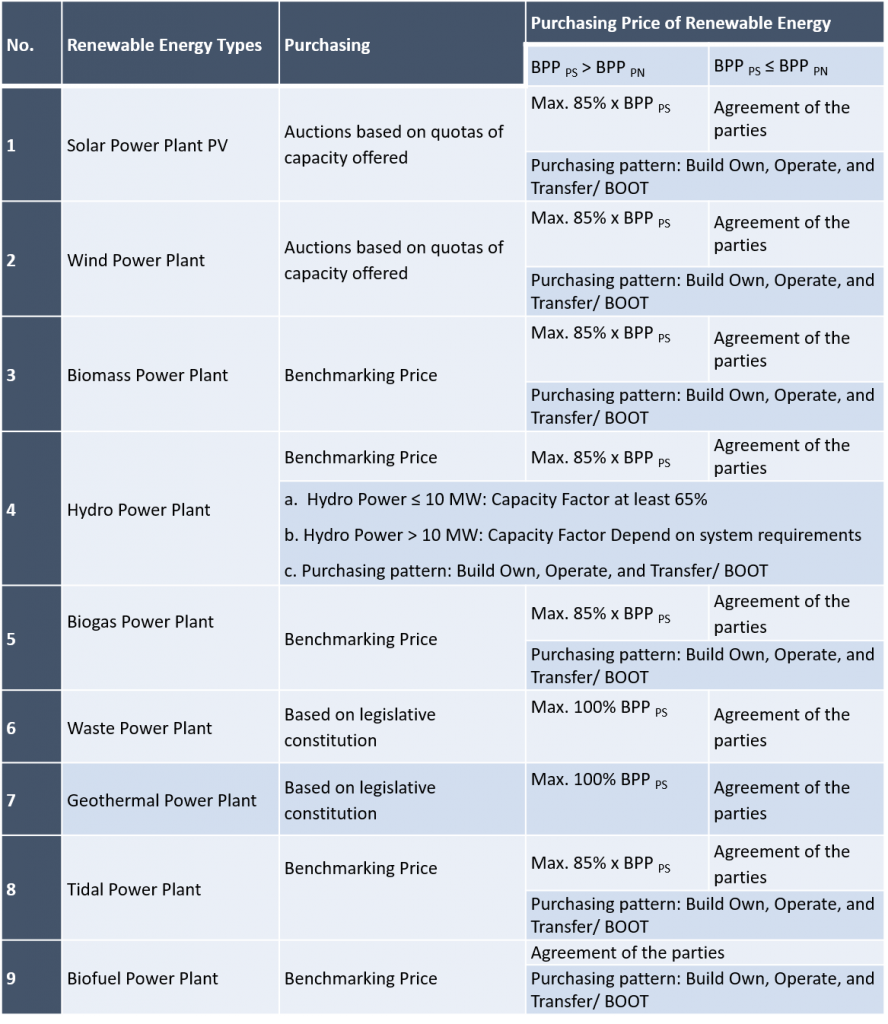

Indonesia’s Support scheme for RE

Source: Ministry Regulation (ESDM) No. 50/2017

Source: Ministry Regulation (ESDM) No. 50/2017

Under Regulation 50/2017, all tariffs (except for geothermal and waste projects.as well as projects where procurement using direct selection process) will be capped at 85% of the local production cost (locally known as the BPP) if the local production cost is higher than the national average production cost. However, if the local production cost is the same or lower than the national average production cost, then the reference price will be 100% of the local production cost.

Regulation 50/2017 does not apply to power purchase agreements (PPAs) that have already been signed. In this case, the signed PPA pricing terms will remain in effect. If a PPA has not been signed but the developer has been designated as the project developer by either the Government or PLN, the pricing will follow the provisions of Regulation 50/2017. There is one exception, however, for geothermal projects. If a geothermal developer has not signed a PPA but has won the auction for the concession in accordance with the existing legislation, the tariff to be used will be the tariff stipulated by the developer in its winning bid and the new FIT for geothermal projects will not apply.

Incentives & Financing Support

Under Regulation 50/2017, all tariffs (except for geothermal and waste projects.as well as projects where procurement using direct selection process) will be capped at 85% of the local production cost (locally known as the BPP) if the local production cost is higher than the national average production cost. However, if the local production cost is the same or lower than the national average production cost, then the reference price will be 100% of the local production cost. The tax incentives for renewable energy-based power projects under Ministry of Finance Regulation No. 21/PMK.011/2010 include:

- Income tax exemption or reduction for 5 or 10 years

- Accelerated depreciation and amortization

- Tax deduction per year of 6 years

- Exemption from VAT

- Accelerated depreciation of capital and fixed assets

- Import duty exemption for renewable energy equipment

The Ministry of Finance regulation No.139/PMK.011/201 states that the government will give financial guarantee for renewable energy plant projects through cooperation with Independent Power Producer (IPP) in the case of payment failure by PLN.

The Geothermal Fund Facility (GFF), Indonesia Infrastructure Guarantee Fund (IGFF), and loans at an interest rate lower than provided by public Banks are available to farmers, for planting palm oil for biofuel.

The Clean Technology Fund (CTF) helps to promote the energy efficiency and renewable energy development in the country and increase the electrification rate up to 90% in 2020. Followed by the US$400 million investment from CTF, the Indonesia’s geothermal power capacity is set to nearly double. In March 2015, US$50 million was allocated for the Geothermal Energy Upstream Development Project of Indonesia.

In order to encourage the utilization of solar power plant (photovoltaic), the Ministry of Energy and Minerals has introduced new regulation (Permen ESDM No. 49/2018) concerning the power usage from PV Rooftop by power utility consumers. This aims to reduce the amount of electricity used by households with power export (to PLN) coefficient of 0.65.